what is the sales tax on cars in south dakota

In addition for a car purchased in South Dakota there are other applicable fees including registration title and. 2 June 2018 South Dakota.

Gov Noem Wants To Cut South Dakota S Grocery Sales Tax What To Know

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Applies to all sales of products and services that are subject to the state sales tax or use tax if the purchaser receives or imposes a sales tax or use tax. The highest sales tax is in Roslyn with a.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and. South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. The South Dakota sales tax and use tax rates are 45. Motor Vehicle Sales and Purchases South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South. Different areas have varying additional sales taxes as well. There are a total of.

What Rates may Municipalities Impose. You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership. They are Delaware Montana New Hampshire Alaska and Oregon.

If a state with no tax or a lower tax rate than South Dakotas 4 then you will need to pay the additional tax rate to match the 4. Counties and cities can charge an. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that.

South Dakota Directors of Equalization knowledge base for property tax exemptions sales ratio and growth definitions. In South Dakota the sales and use tax rate is 45. As of March 1 2019 marketplace providers who meet certain thresholds must obtain a South Dakota sales tax license and pay applicable sales tax.

Who This Impacts Marketplace. Car sales tax in South Dakota is 4 of the price of the car. States with sales tax below 5 are Colorado at 29.

31 rows The state sales tax rate in South Dakota is 4500. 4 State Sales Tax and Use Tax Applies to. With local taxes the total sales tax rate is between 4500 and 7500.

Tax Basics South Dakota Taxes and Rates State Sales Tax and Use Tax Applies to all sales or purchases of taxable products and services. The laws applicable in South Dakota allow a business person to include sales tax on the price of the products or services they offer. How Much Is the Car Sales Tax in South Dakota.

Exact tax amount may vary for different items. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933.

Several examples of of items that exempt from South. How much is sales tax in South Dakota. All car sales in South Dakota are subject to the 4 statewide sales tax.

South Dakotas sales and use tax rate is 45 percent. The base state sales tax rate in South Dakota is 45. 45 Municipal Sales and Use Tax Applies to all.

There are a total of five states with no sales tax. Can I import a vehicle into South. You have 90 days from your date of arrival to title and.

The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes alcohol taxes. Its important to note that this does include any local or county sales. Average Sales Tax With Local.

South Dakota has recent rate changes Thu.

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Taxes In The United States Wikipedia

Motor Vehicle South Dakota Department Of Revenue

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Taxes In The United States Wikipedia

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident

Sales Use Tax South Dakota Department Of Revenue

Exclusive Gop Gov Kristi Noem Announces Largest Tax Cut In South Dakota History Fox News

South Dakota Car Title How To Transfer A Vehicle Rebuilt Or Lost Titles

Used 2006 Honda Cr V For Sale In South Dakota With Photos Cargurus

Used Cars For Sale In Sioux Falls Sd Under 10 000 Cars Com

Nj Car Sales Tax Everything You Need To Know

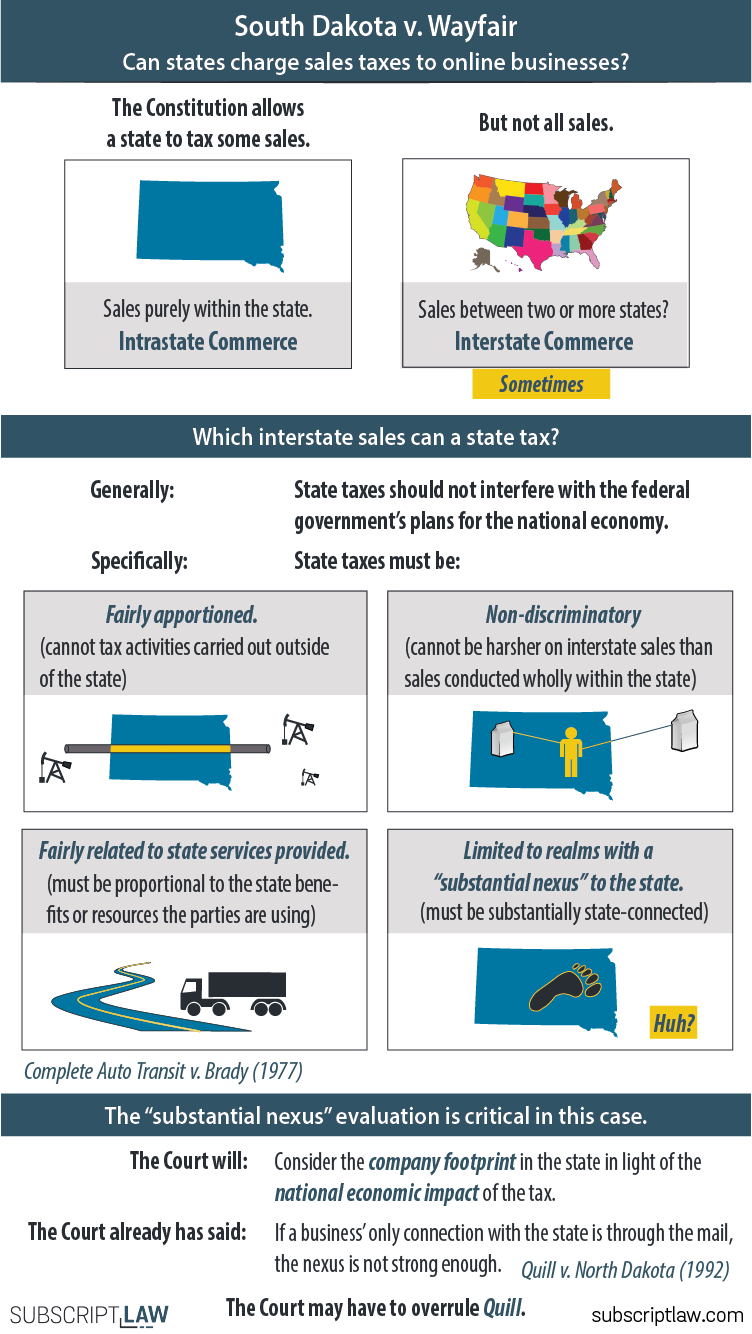

South Dakota V Wayfair Argument April 17 2018 Subscript Law

Used Cars For Sale In Sioux Falls Sd Cars Com

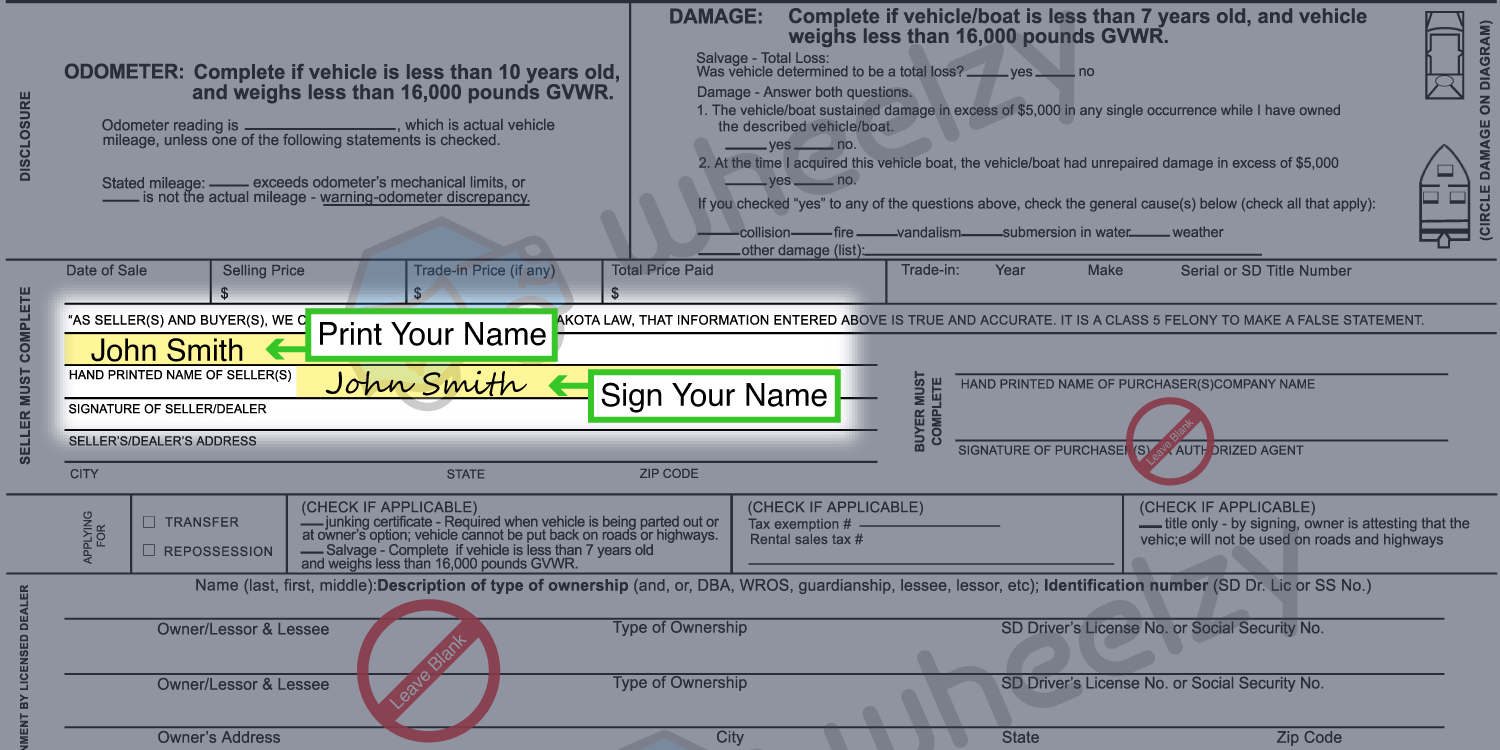

How To Sign Your Car Title In South Dakota Including Dmv Title Sample Picture

All Used Inventory Sioux Falls South Dakota 57104 Nb Golf Cars